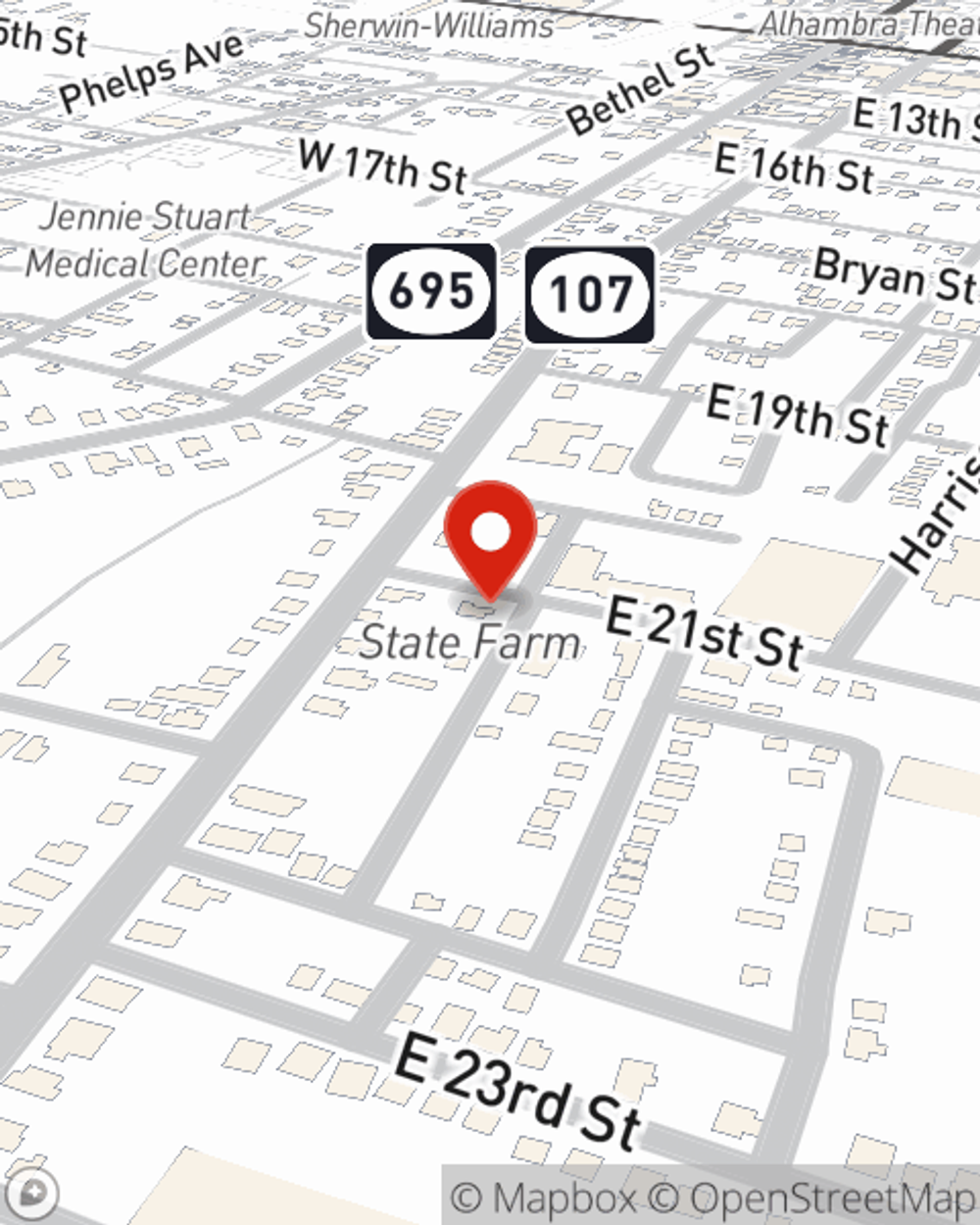

Homeowners Insurance in and around Hopkinsville

If walls could talk, Hopkinsville, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

Home is where family gathers memories are created, and you're protected with State Farm's homeowners insurance. It just makes sense.

If walls could talk, Hopkinsville, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Homeowners Insurance You Can Trust

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your largest asset safe. You’ll get a policy that’s adjusted to accommodate your specific needs. Luckily you won’t have to figure that out on your own. With true commitment and excellent customer service, Agent Tom Bell can walk you through every step to create a policy that shields your home and everything you’ve invested in.

Your home is important, but unfortunately, the unforeseeable circumstance can happen. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Tom Bell can help you get the home coverage you need!

Have More Questions About Homeowners Insurance?

Call Tom at (270) 885-2982 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Closing documents to keep after purchasing a house

Closing documents to keep after purchasing a house

A guide to the closing documents to keep after you buy your house — and what you can consider getting rid of.

What to do during a tornado

What to do during a tornado

You see the alert. Your area is under a tornado watch, or even worse, a tornado warning. Know the differences between them, and what to do during a tornado.

Simple Insights®

Closing documents to keep after purchasing a house

Closing documents to keep after purchasing a house

A guide to the closing documents to keep after you buy your house — and what you can consider getting rid of.

What to do during a tornado

What to do during a tornado

You see the alert. Your area is under a tornado watch, or even worse, a tornado warning. Know the differences between them, and what to do during a tornado.